Should You Buy or Lease Your Next Vehicle?

New vehicle prices have skyrocketed these past few years, with the cost averaging well over $48,到2023年底.1 这些增加的成本, coupled with rising interest rates, mean that buying a vehicle can take a significant bite out of your budget. If you are in the market for a new vehicle, you might be wondering if leasing it would save you money.

As a rule, if you plan on keeping a vehicle for a long period of time, it makes more sense to buy it. But if having the latest technology and safety features is important to you, leasing might be the best option, allowing you to drive a new vehicle every few years. To help you decide, you should also determine how each option fits into your lifestyle or budget. Here are some points to consider.

所有权

当你买车的时候, you usually finance a portion of the purchase price and pay it back over time with interest. When the loan term ends and the vehicle is paid for, you own it. You can keep it as long as you like, and any retained value (equity) is also yours to keep.

当你租车的时候, you don’t own it — the leasing company does — so you do not have any equity built up once the lease is over. 在租期结束时, you can choose to either return the vehicle or buy it at its residual value, 租约中规定了什么. If you end up returning it early, the dealer may require you to pay a hefty fee. If you still need a vehicle at the end of the lease term, you’ll need to start the leasing (or buying) process all over.

按月支付

If you finance all or part of your new vehicle purchase, you will have a monthly payment that will vary based on the amount you finance, 利率, 贷款期限. 比较贷款时, it’s important to look at the total amount of money you will end up paying over the life of the loan. While a longer loan term may give you a more affordable monthly payment, you will end up paying more money over the loan term.

在一般情况下, monthly lease payments are usually lower than monthly loan payments since you are mainly paying for the vehicle’s depreciation during the lease term as opposed to the purchase price. This means that leasing may allow you to drive a more expensive vehicle than what you could otherwise afford.

里程

你打算开多久的车? 当你买车的时候, you can drive it as many miles as you want. 然而, a vehicle with higher mileage may be worth less if you plan to trade it in or sell it at some point down the road.

Vehicle leases come with up-front mileage limits, 通常从12,000 to 15,每年000英里. 如果你超过了这些限制, you can end up incurring costly penalties in the form of excess mileage charges.

维护

当你卖掉你的车, 条件很重要, so you may receive less if it hasn’t been well maintained. 随着车辆的老化, 维修费用可能会更高, something you typically won’t encounter if you lease.

Generally, you will have to service a leased vehicle according to the manufacturer’s recommendations. 除了, you’ll need to return your vehicle with normal wear and tear (according to the leasing company’s definition). Anything above normal wear and tear may result in excess charges.

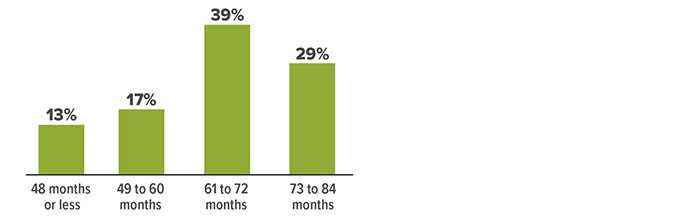

新车贷款的份额, by loan term

资料来源:Experian, 2023

前期的成本

当你买车的时候, the up-front costs you incur may include the cash price or a 首付 for the vehicle, 税, title, 以及其他费用.

The up-front costs associated with leasing a vehicle may include an acquisition fee, 首付, 押金, 第一个月的付款, 税, title, 以及其他费用.

额外购买vs. 租赁建议

Keep the following tips in mind when determining whether or not to buy or lease a vehicle:

- 明智的购物. Advertised deals may be too good to be true once you read the fine print. Make sure you fully understand all terms or conditions.

- 谈判. 为了得到最好的交易, be prepared to negotiate the price of the vehicle and the terms of any loan or lease offer.

- 计算数字. Calculate both the short-term and long-term costs associated with each option.

- Factor in any tax incentives or implications. This is especially true if you plan to use your vehicle for business or are shopping for an electric vehicle.