Investor, Know Thyself: How Your Biases Can Affect Investment Decisions

Traditional economic models are based on the premise that people make rational decisions to maximize economic and financial benefits. In reality, most humans don’t make decisions like robots. 而逻辑确实指引着我们, 感觉和情绪——比如恐惧, 兴奋, and a desire to be part of the “in” crowd — are also at work.

In recent decades, another school of thought has emerged. This field — known as behavioral economics or behavioral finance — has identified unconscious cognitive biases that can influence even the most stoic investor. Understanding these biases may help you avoid questionable financial decisions.

听起来很熟悉?

What follows is a brief summary of how some common biases can influence financial decision-making. 你能联想到这些场景吗?

锚定 refers to the tendency to become attached to something, even when it may not make sense. Examples include a home that becomes too much to care for or a piece of information that is believed to be true despite contradictory evidence. 在投资, it can refer to the tendency to hold an 投资 too long or rely too much on a certain piece of data or information.

损失厌恶偏见 describes the tendency to fear losses more than to celebrate gains. 例如, you may experience joy at the chance of becoming $5,000年富, 但是害怕失去5美元,可能会引发更大的焦虑, causing you to take on less 投资 risk than might be necessary to pursue your goals.

的 禀赋效应 is similar to anchoring in that it encourages you to “endow” what you currently own with a greater value than other possibilities. You may presume the 投资s in your portfolio are of higher quality than other available alternatives, 仅仅因为你拥有它们.

过分自信 is having so much confidence in your own ability to select 投资s that you might discount warning signals or the perspective of more experienced professionals.

确认偏误 is the tendency to assign more authority to opinions that agree with your own. 例如, you might give more credence to an analyst report that favors a stock you recently purchased, in spite of several other reports indicating a neutral or negative outlook.

的 从众效应也被称为 羊群行为, happens when decisions are made simply because “everyone else is doing it.” This can result in buying high and selling low — what most knowledgeable investors strive to avoid.

错过的风险

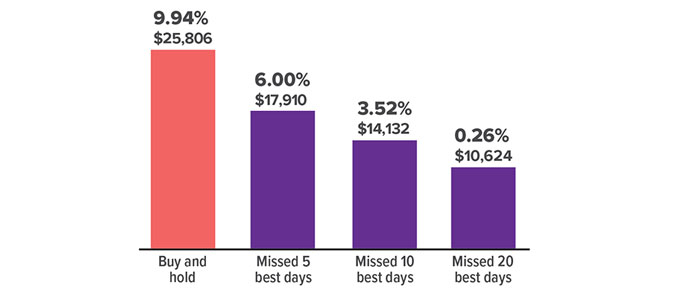

Emotion-based decisions can have a significant impact on your portfolio over time. Consider how much a long-term investor might have lost by shifting in and out of the market due to fear, 过分自信, 或者随波逐流, and subsequently missing the best-performing days over the 10-year period ended 2023.

Growth of $10,000 initial 投资, with average annual return, 2014–2023

来源:雅虎财经,2024年,美国&P 500 Index for the period 12/31/2013 to 12/31/2023. 的年代&P 500 Index is an unmanaged group of securities considered to be representative of the U.S. 股票市场总体情况. 的 performance of an unmanaged index is not indicative of the performance of any specific 投资. 个人不能直接投资于任何指数. Past performance is no guarantee of future results. 实际结果会有所不同.

近因效应”(或近期偏差) refers to the fact that recent events can have a stronger influence on your decisions than those in the past. 例如, if you were severely affected by market gyrations in the early days of the pandemic, you may have wanted to sell your stock holdings due to fear. 相反, if you were encouraged by the stock market’s strong performance in 2023, you may have wanted to pour all your money into equities. Yet either of these actions might not have been appropriate for your 投资 goals and personal circumstances.

客观的观点会有所帮助

When it comes to our finances, instincts may work against us. 在对你的投资组合采取任何行动之前, it might be wise to seek the counsel of a qualified financial professional who can help you identify any unconscious biases at work.

所有投资都有风险, 包括可能的本金损失, and there is no guarantee that any 投资 strategy will be successful. 的re is no assurance that working with a financial professional will improve 投资 results.